In an era where insurance premiums are climbing and operational costs are under scrutiny, telematics has emerged as a game-changer for both individual drivers and fleet operators. By leveraging vehicle tracking technology, insurers can assess risk more accurately, rewarding safe driving behaviors with reduced premiums. This blog explores how telematics functions and how it can lead to significant savings on insurance costs.

Understanding Telematics in Insurance

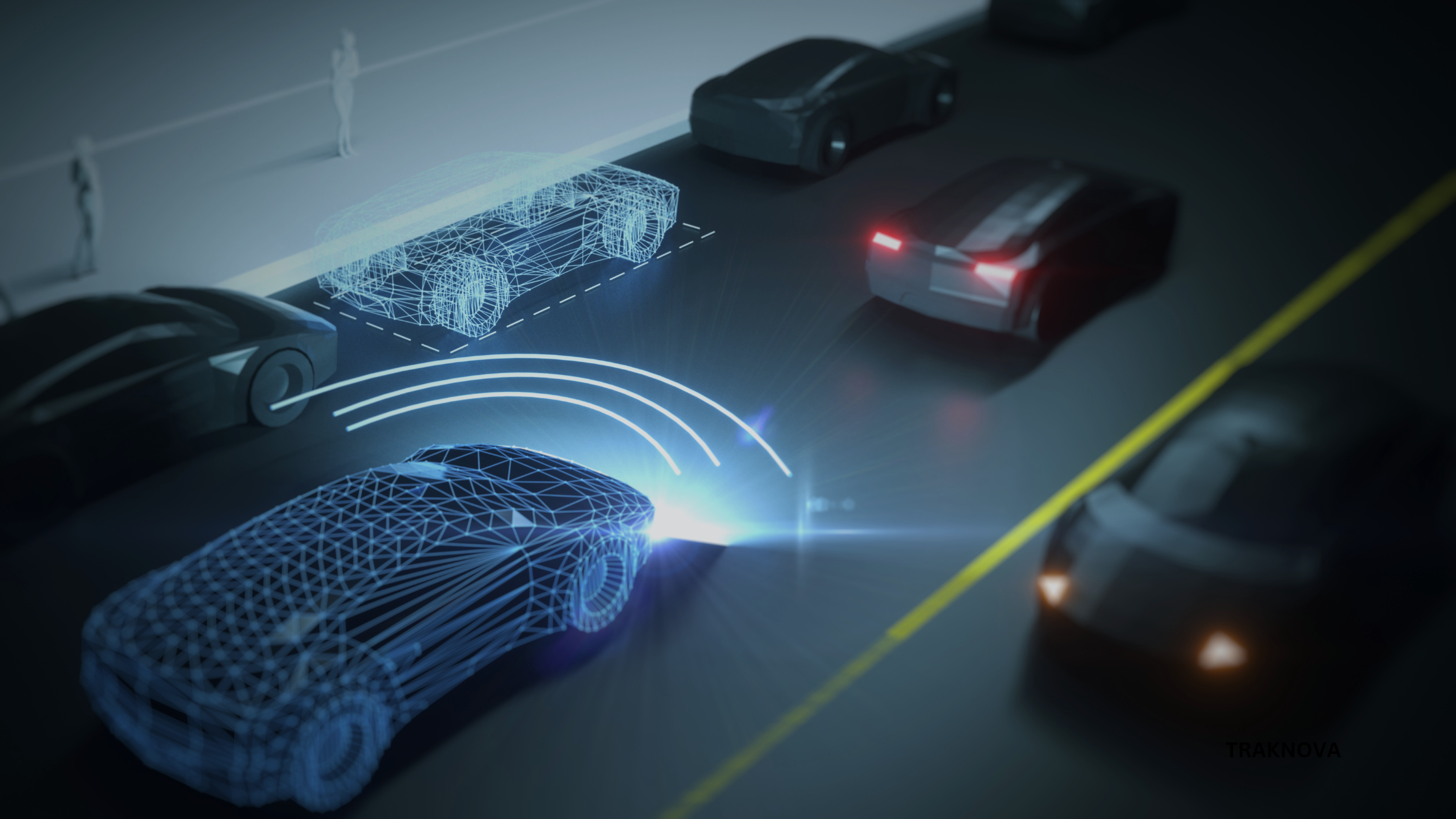

Telematics involves the integration of telecommunications and informatics to monitor and transmit data regarding vehicle usage. In the insurance sector, this technology enables the collection of real-time data on driving behaviors, such as speed, braking patterns, and mileage. Insurers utilize this information to tailor premiums more closely to individual risk profiles, promoting fairness and incentivizing safer driving habits.(The US Sun)

How Telematics Influences Insurance Premiums

1. Personalized Premiums Based on Driving Behavior

Traditional insurance models often rely on generalized factors like age and location. Telematics allows for a more nuanced approach, assessing actual driving habits to determine risk. Safe drivers exhibiting responsible behaviors can benefit from lower premiums, while riskier driving may lead to higher costs.(Wikipedia, Family1st)

2. Encouragement of Safer Driving Practices

The awareness that driving behavior is being monitored can lead to more cautious driving. This not only enhances road safety but also reduces the likelihood of accidents, leading to fewer claims and, consequently, lower insurance costs.

3. Efficient Fleet Management

For businesses operating vehicle fleets, telematics provides insights into driver performance and vehicle usage. This data can inform training programs, maintenance schedules, and route planning, all contributing to reduced operational costs and insurance premiums.

Benefits of Telematics for Insurance Savings

| Benefit | Description |

|---|---|

| Accurate Risk Assessment | Real-time data allows insurers to evaluate risk based on actual behavior. |

| Cost Savings | Safe driving habits can lead to significant reductions in premiums. |

| Enhanced Security | Vehicle tracking aids in theft recovery, potentially lowering claims. |

| Operational Efficiency | Insights into vehicle usage optimize fleet management and reduce expenses. |

Implementing Telematics: Steps to Take

- Install Telematics Devices: Equip vehicles with telematics hardware or use smartphone apps provided by insurers.

- Monitor Driving Behavior: Regularly review the data collected to understand driving patterns and identify areas for improvement.(Family1st)

- Engage with Insurers: Communicate with your insurance provider to understand how telematics data influences your premiums and what discounts are available.

- Promote Safe Driving: Use the insights gained to encourage safer driving habits among all drivers in your household or organization.

Conclusion

Telematics offers a proactive approach to managing insurance costs by aligning premiums with actual driving behavior. By embracing this technology, drivers and fleet operators can not only achieve financial savings but also contribute to safer roads.

Interested in leveraging telematics for your fleet? Explore Traknova’s advanced tracking solutions to enhance safety, efficiency, and cost-effectiveness in your operations.