Demo vehicles sound convenient. They let sales teams showcase models, provide loaners for customers and keep a pipeline of vehicles turning over. But if you manage a fleet, you already know that small conveniences can quietly become recurring costs. This article digs into the practical, often overlooked expenses and risks associated with demo vehicles, and shows how to control them without hampering business needs. Read on for pragmatic steps you can use today.

What are demo vehicles and why they matter

Definition and common uses

Demo vehicles include dealer demos, test-drive cars, and loaners that get used for short-term customer requirements or marketing. You might also see company-owned demonstrators that sales teams use for shows and customer demonstrations. These vehicles are not part of your day-to-day task fleet but they are still assets that wear, depreciate and attract costs. It helps to treat them as a separate asset class with its own rules.

How demo vehicles differ from regular fleet assets

Demo vehicles face a mixed user base. Drivers can range from experienced staff to prospective clients who have never handled your brand of vehicle. That variability increases risk of cosmetic damage, unusual wear patterns and inconsistent servicing. They also tend to have higher turnover and market stigma as “used” sooner than your regular fleet assets. In short, demo cars are useful, but they behave differently. Recognising that distinction is the first step to managing the hidden costs.

Direct costs of demo vehicles

Accelerated depreciation and lower resale value

One of the biggest direct hits is residual value erosion. A vehicle logged as a demo—especially if it accumulates miles in short bursts—sells for less than one used only in normal fleet rotation. Buyers often penalise demo mileage because it signals mixed handling and potential unseen knocks. The result: higher total cost of ownership per kilometre. If you are not tracking demo kilometres separately, you will understate depreciation and make bad procurement choices.

Increased maintenance, repairs and consumables

Because demo cars see varied drivers and short, intense usage, they often need tyres, brakes and services sooner than expected. You may notice more cosmetic repairs too, like scuffs, dents and interior stains. Those small fixes add up fast. Factor in cleaning between users and you have recurring spend that is easy to underestimate.

Insurance, registration and tax implications

Insurance premiums can be higher for demo fleets because of elevated risk profiles. Policies may treat demo or rental-style usage differently from business-only usage. There can also be registration and tax consequences depending on your jurisdiction and whether vehicles are used commercially or for marketing. Talk to your insurer and finance team to ensure these are properly categorised and costed.

Indirect and hidden costs

Downtime, reduced availability and opportunity cost

When a demo vehicle is tied up for marketing or a long test drive, it is not available for operational needs. That can force you to hire temporary replacements, pay overtime or reshuffle routes. The opportunity cost—lost productivity or delayed jobs—often dwarfs the visible repair bills. Track availability and you will spot these inefficiencies quickly.

Administrative, logistics and tracking overhead

Managing demo allocations means more paperwork and logistics. Scheduling, handovers, insurance declarations and pre/post inspections eat admin hours. This is where modern tracking and digital logbooks for loaner vehicles can save time and reduce errors. If you are still doing handwritten forms, you are spending more than you think.

Brand reputation and liability exposure

Poor demo experiences can damage reputation. Imagine a prospective customer receiving a grubby demo with mechanical issues. That impression can influence buying decisions and spread on social channels. There is also liability exposure: accidents in demo vehicles can lead to complex claim scenarios. Strong policies and visibility are essential to protect brand trust and legal standing.

Operational and compliance risks

Warranty, recall and compliance complications

Demo usage can impact warranty claims. Some manufacturers or suppliers expect standard usage profiles; heavy or irregular demo use might complicate coverage. Recalls and safety notices also need a tight tracking process so every demo is brought in promptly. Neglecting this creates safety risks and potential non-compliance with industry regulations.

Security, theft and misuse risks

Demo vehicles can be easier targets for theft or unauthorised use because they are frequently loaned out. Higher turnover increases the chance of lapses in key control or verification. Use of vehicles by third parties raises security concerns too. Investing in alarmed immobilisers, remote immobilisation and robust access controls reduces both the risk and the follow-up costs of recovery and replacement. If you want to tighten this rapidly, see our guide on GPS Tracking to Prevent Vehicle Theft.

Strategies to mitigate and manage costs

Policy, allocation and lifecycle planning

The simplest wins start with rules. Set caps on demo mileage, limit demo duration, and define acceptable users. Decide early whether a vehicle will be a demo from day one; that way you can plan its lifecycle and expected residual. Consider purpose-built demo pools instead of cannibalising operational assets. These steps reduce surprises and make budgeting straightforward.

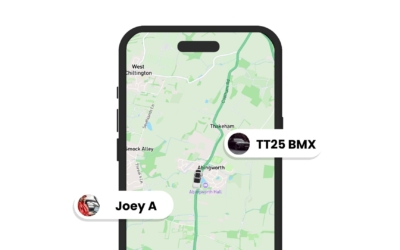

Telematics, inspections and data-driven controls

Telematics is no longer optional. Real-time monitoring gives you driver behaviour, idle time, location history and maintenance triggers. Combine that with scheduled inspections and you catch misuse earlier and plan servicing more efficiently. If you want to see how these tools work in practice, book demo with Traknova and we will show you tailored setups for demo fleets.

Disposition and remarketing best practices

Timing sells. Hold vehicles too long and you eat depreciation; sell too early and you may lose resale optimisation. Reconditioning between sales, transparent demo histories and targeted remarketing channels usually yield higher recovery. Consider refurbishing aesthetics and documenting every service to reassure buyers and lift sale prices. Our post on Fleet Insights for Smarter Vehicle Procurement covers procurement-to-disposition thinking in more detail.

KPIs, reporting and a practical implementation checklist

Key metrics to track

Measure what matters. Track cost per kilometre, residual value delta between demo and fleet units, demo downtime, repair frequency and admin hours per demo. These KPIs show where you are bleeding money and help build the business case for changes like dedicated demo pools or telematics rollout. Dashboards that highlight anomalies are a huge time-saver.

Short-term wins and long-term steps

Start with a checklist: implement demo policies, tag demo vehicles in your system, enable tracking and schedule inspections. Next, analyse 90-day trends, adjust thresholds and set disposal windows. For long-term improvement, integrate demo data into procurement decisions and standardise remarketing. A phased approach makes the work manageable and fast to justify financially.

Conclusion

Demo vehicles bring value but they also introduce a web of hidden costs: faster depreciation, higher maintenance, admin burdens and reputational risks. The good news is these are controllable. With clear policy, telematics-driven oversight and smarter remarketing, you can keep demos working for the business rather than against it. If you want a practical walkthrough tailored to your fleet size and use case, book demo or schedule a consultation with Traknova’s team today.

Frequently Asked Questions

How should I track demo mileage separately from my operational fleet?

Tag demo vehicles in your fleet system and use telematics to log kilometres by vehicle tag. Regular automated reports will keep demo metrics visible and separate from core fleet usage.

Does demo use void manufacturer warranties?

Not automatically, but heavy or non-standard use can complicate claims. Keep detailed service records and consult manufacturers if you plan high demo intensity.

What is a reasonable demo mileage cap?

There is no one-size-fits-all number. Start by analysing your fleet’s average mileage then set a cap that reflects demo purpose—commuter demos can have lower caps than sales demonstrators. Review quarterly.

Can telematics really reduce demo costs?

Yes. Telematics reduces misuse, enforces inspections and improves scheduling. Each of these cuts direct or indirect costs, often paying back investment quickly.

Should demos be sold through wholesale channels or direct to consumers?

Both have merits. Wholesale is fast; direct often captures higher pricing if you invest in reconditioning and documentation. Test both and track the residual outcomes.

Want to tell us what you think? I’d love your feedback — did this article help you spot a cost you hadn’t considered? Please leave a comment, share the post with your peers and tag someone who manages demo or loaner vehicles. Which hidden cost surprised you most?

Ready to act? Book a demo with Traknova to see how targeted tracking, security features and reporting can reduce demo-related spend. Or contact us for a consultation.

If you found this useful, please share it on LinkedIn or with your fleet management network. Thanks for reading.